Gold prices moved higher overnight in the Far East despite a stronger dollar and higher equity prices. When the spot price broke thru the $1,185 resistance level, a price point many traders and short speculators were concerned with, some nervous shorts started to cover and exit the market.

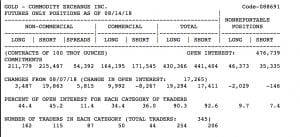

The most recent Commitment of Traders Report (COT), shown below, revealed with certainty that the Gold market was seriously oversold.

I cannot say I remember in any of my 42 years in the business that I have seen a net short fund position in the COT report. I stand to be corrected, but I searched for reports as far back as 1999 and I couldn’t find at any point a COT report with a net short position. (Click the image for a larger view)

Two factors have caused the price of Gold to change direction: First the rally in the U.S. Dollar seemed to have stalled and then the release late Friday afternoon of the most recent COT report.

So at this juncture, traders will be watching to see if the price of Gold can maintain its price above the $1,185 level. If not, the remaining shorts will stay put and watch the activity in the market before making a move to cover.

But let’s not forget that the price of Gold still remains below the psychological level of $1,200 and the price has been primarily battered by strength in the U.S. dollar, so we still have to watch the activity very closely in that market. The Dollar Index has advanced 4.6% so far this year and about 2% in August.

Remember, a stronger dollar can be a negative for Gold as it makes dollar denominated assets, like Gold and Silver, more expensive for buyers using other currencies.

In the meantime, all market participants will continue to focus on geopolitical events, (especially with Turkey and other emerging markets), any unexpected news out of the White House, Q2 corporate earnings, oil prices, and unnecessary comments from any Fed members between meetings.

Have a wonderful Monday.

Disclaimer: This editorial has been prepared by Walter Pehowich of Dillon Gage Metals for information and thought-provoking purposes only and does not purport to predict or forecast actual results. This editorial opinion is not to be construed as investment advice or as a recommendation regarding any particular security, commodity or course of action. Opinions expressed herein cannot be attributable to Dillon Gage. Reasonable people may disagree about the events discussed or opinions expressed herein. In the event any of the assumptions used herein do not come to fruition, results are likely to vary substantially. It is not a solicitation or advice to make any exchange in commodities, securities or other financial instruments. No part of this editorial may be reproduced in any manner, in whole or in part, without the prior written permission of Dillon Gage Metals. Dillon Gage Metals shall not have any liability for any damages of any kind whatsoever relating to this editorial. You should consult your advisers with respect to these areas. By posting this editorial, you acknowledge, understand and accept this disclaimer.