No movement in the Dollar Index nor in the Ten-Year Treasury Yields, so it’s no surprise that the price of Gold is virtually unchanged.

The CBOE VIX Index is heading lower as Equity market participants continue to believe that the economic footing is on solid ground.

Unfortunately, many economists are taking the other side of that message as they know higher interest rates will only increase the household and individual debt which is currently at a historic highs and going higher.

The State of (Some of) The States

On Wednesday, I spoke about our country’s runaway debt. In good conscience I can’t leave out the seriousness of the financial condition of some of our 50 states.

Let’s break this down with some details that might clear up the differences between the Federal Government and our state Governments.

After reading the CBO report last week that illustrated in detail that our countries debt will be rising faster than expected due to the reduction in tax revenue, I noticed that no one in the media was also addressing the sad state of affairs some of our states are in.

I’ve heard a lot of Capital Hill representatives telling the governors of some of the Blue States that have been effected by the elimination of the (SALT) state and local taxes to step up to the plate, stop crying and lower your taxes, too. Well it’s not easy for the likes of New York, New Jersey and others. On the Federal level, you have a huge cost of entitlements to contend with. Whereas on the state level, you have a huge cost of obligations, UNION OBLIGATIONS.

Here is a story published in Market Watch back in January this year.

“The recently enacted U.S. tax law restricts federal deductions for state and local taxes (SALT) to $10,000 including local property and sales taxes as well as local income taxes. While this new restriction will have many implications, it will have a particularly draconian impact on states with large unfunded liabilities for pension benefits and retiree health care, in particular the residents of Illinois, Kentucky, Connecticut, and New Jersey.

“Unless states can implement effective ways to circumvent the SALT restriction, they will face much higher political barriers to meeting their unfunded benefit obligations through increased tax revenues. Instead, states will be forced to severely cut spending on public services and/or adopt major reforms of their benefit plans.

“A state has payment obligations from three main sources — interest on its outstanding bonds, unfunded liabilities for pension benefits, and unfunded liabilities for health care payments to state retirees (before Medicare at age 65). The interest on outstanding state bonds is relatively easy to estimate; the total outstanding amount of all state bonds was $500 billion in 2016. With the advent of improved accounting rules, it is now possible to compute the unfunded pension and retiree health care liabilities of each state.

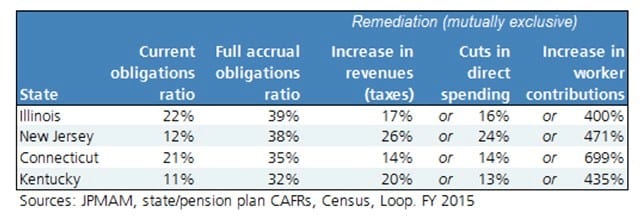

The table below summarizes the situation for each of four states with the highest unfunded liabilities relative to their revenues in 2016 Illinois, New Jersey, Connecticut and Kentucky. The data in the table come from the Investment Strategy Team at JP Morgan Asset Management.

“The table shows the “current obligations ratio” for each state — the percentage of its revenues currently devoted to paying down its unfunded pension and retiree health care obligations plus interest on its state bonds. The table then compares that ratio to each state’s “full accrual obligations ratio.” This latter ratio was calculated based on two reasonable assumptions — first, that state should pay down their unfunded pension and retiree health care liabilities over 30 years, and, second, that annual investment returns of states would average 6% over this period.

“As the table shows, the gap between the two ratios could be filled by increases in state tax revenues. To cover the gap, however, states would have to raise local taxes by an eye-watering amount — ranging from 14% in Connecticut to 26% in New Jersey.

“These large increases in state revenues are not feasible, as illustrated by Illinois. To cope with its mammoth unfunded benefit obligations, Illinois has sharply raised tax rates on both individuals and businesses over the past few years. But higher tax rates in Illinois have backfired driving local residents and firms to other states. In 2015, for example, Illinois lost $4.75 billion in adjusted gross income to other states, according to IRS data.”

Now that I have bored you with the state details, it seems obvious that some states might be in worse shape than the Federal Government due to their contracted obligations. It seems that the Federal government, now more than ever, will be turning its back financially on each state in need and leave it up to them to solve their own problems .

Where will each state get the funds to pay for this debt? And how will the states pay for all other costs such as healthcare and infrastructure? No one seems to have an answer.

So after reading how bad things are getting on the Federal side of the ledger and how dismal the financial condition is for many states, are you convinced that time has run out?

Let’s call it like we see it, Washington and Wall Street got their way securing the corporate tax cuts. But with cutting taxes instead of increasing them – we all knew the economy was expanding and a tax cut was totally unnecessary – we now see that was it a major mistake as all it did was increase the country’s debt and eliminate any help for the states that need it the most. (Not to mention what a burden this imposes on our children and grandchildren.)

For those old enough to know the definition of a broken record, I can’t move the needle off the vinyl fast enough as I keep repeating, “you really should consider owning Physical Precious Metals,” because ( I’ll leave you with one more old saying ) “curses are like chickens; they always come home to roost,” meaning that your offensive words or actions are likely at some point to rebound on you.

Have a wonderful Friday.

Disclaimer: This editorial has been prepared by Walter Pehowich of Dillon Gage Metals for information and thought-provoking purposes only and does not purport to predict or forecast actual results. This editorial opinion is not to be construed as investment advice or as a recommendation regarding any particular security, commodity or course of action. Opinions expressed herein cannot be attributable to Dillon Gage. Reasonable people may disagree about the events discussed or opinions expressed herein. In the event any of the assumptions used herein do not come to fruition, results are likely to vary substantially. It is not a solicitation or advice to make any exchange in commodities, securities or other financial instruments. No part of this editorial may be reproduced in any manner, in whole or in part, without the prior written permission of Dillon Gage Metals. Dillon Gage Metals shall not have any liability for any damages of any kind whatsoever relating to this editorial. You should consult your advisers with respect to these areas. By posting this editorial, you acknowledge, understand and accept this disclaimer.