Smart investors are well-versed in diversifying their portfolios with gold, silver, and platinum. So, it makes sense that these popular metals have made the headlines in recent years. But in the background, an inconspicuous industrial metal has been on a stealthy bull run: Palladium.

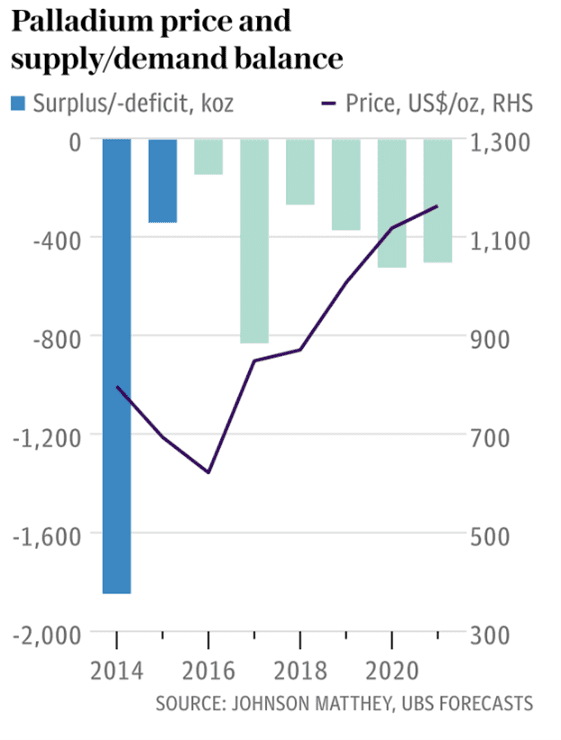

Palladium’s price has soared 370% in the past five years alone, making it more valuable than gold and other major precious metals. What is behind Palladium’s strong performance in recent years? Let’s take a closer look at why you may not want to sleep on Palladium.

Auto Demand Drives Palladium

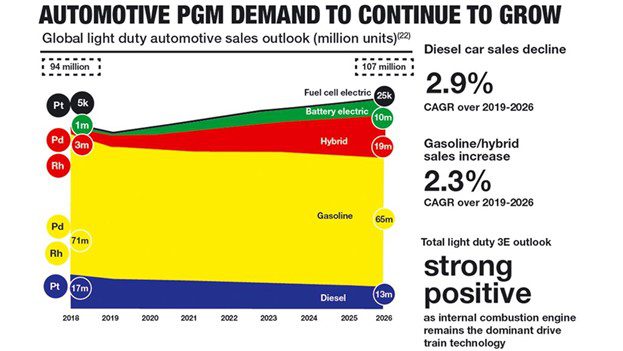

Unlike gold, which has limited industrial uses, palladium is a workhorse. Gas and hybrid vehicle catalytic converters account for about 85% of the world’s supply, where the metal aids in absorbing harmful pollutants before they are emitted into the air. Tighter environmental regulations and increased auto demand in China and the United States, where consumers are still hungry for gas and hybrid-powered cars and trucks, have been significant drivers for palladium.

With a rebounding Chinese economy, ongoing economic stimulus in the United States, and aggressive emission reduction targets by both countries, the demand for catalytic converters – and in turn, palladium – won’t wane anytime soon.

The Palladium Shortage

Palladium is extremely rare, making up only .0005 ppm of the earth’s crust (about ten times less than platinum). Only two nations control most of the world’s palladium supply, Russia and South Arica. Even a tiny mining disruption could cause supply shocks that reverberate worldwide. So, it’s no surprise that the palladium market is in a supply shortage for the 10th year in a row.

Nornickel is Russia’s only supplier of palladium and is also the world’s leading producer. Last year, flooding at two of Nornickel’s mines suspended those mine operations, further driving up palladium’s price. And ongoing threats of Russia curtailing exports due to political sanctions and regulations is a constant supply risk.

Palladium in a portfolio

When it comes to investing in precious metals, investors should not only think of gold and silver. 2021 may have seen a stabilizing in many markets, but palladium’s underlying fundamentals are unlikely to change any time soon. After all, there’s little that can be done to boost supply, and demand shows no sign of slowing. The truth is, industrial metals like palladium, whose value has more of a direct supply and demand relationship, can play a significant role in diversifying a portfolio.

When it comes to investing in precious metals, investors should not only think of gold and silver. 2021 may have seen a stabilizing in many markets, but palladium’s underlying fundamentals are unlikely to change any time soon. After all, there’s little that can be done to boost supply, and demand shows no sign of slowing. The truth is, industrial metals like palladium, whose value has more of a direct supply and demand relationship, can play a significant role in diversifying a portfolio.

Physical bullion such as bars or coins are the most direct way to invest in palladium. Now is the time to talk to your customers about palladium’s long-term investment value in any bullion portfolio.

Disclaimer: This editorial has been prepared by Dillon Gage Metals for information and thought-provoking purposes only and does not purport to predict or forecast actual results. This editorial opinion is not to be construed as investment advice or as a recommendation regarding any particular security, commodity or course of action. Opinions expressed herein cannot be attributable to Dillon Gage. Reasonable people may disagree about the events discussed or opinions expressed herein. In the event any of the assumptions used herein do not come to fruition, results are likely to vary substantially. It is not a solicitation or advice to make any exchange in commodities, securities or other financial instruments. No part of this editorial may be reproduced in any manner, in whole or in part, without the prior written permission of Dillon Gage Metals. Dillon Gage Metals shall not have any liability for any damages of any kind whatsoever relating to this editorial. You should consult your advisers with respect to these areas. By posting this editorial, you acknowledge, understand and accept this disclaimer.