As we start another Presidential Inauguration Day, it seems like a good time to look back at how gold has reacted to past presidents, at least since the restrictions on owning gold were lifted at the beginning of 1975, under Pres. Nixon.

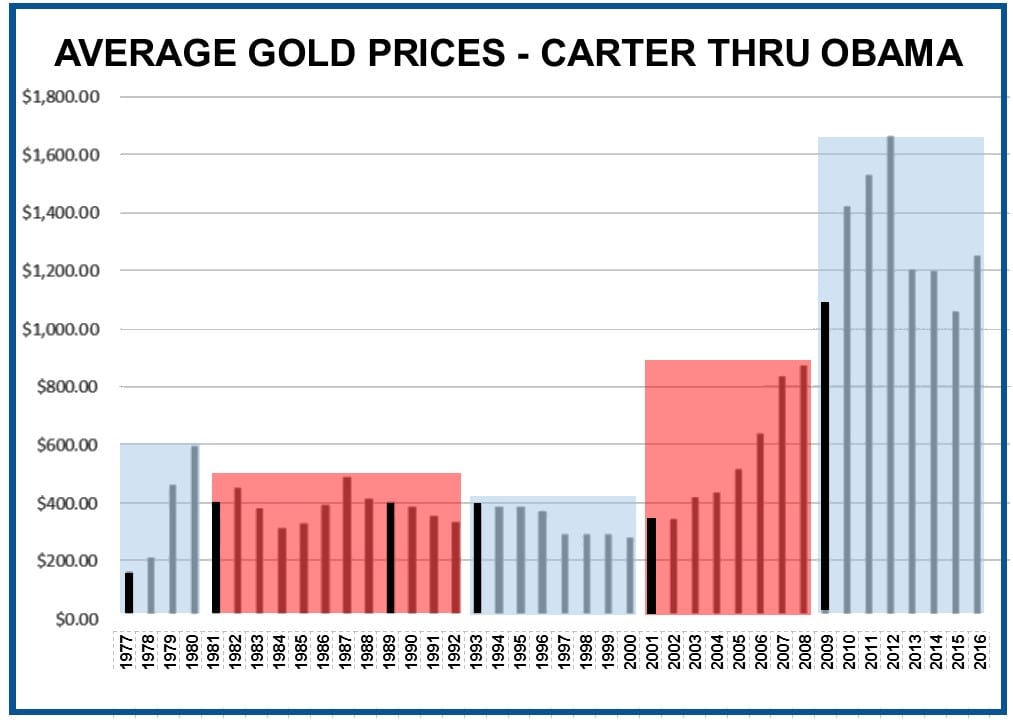

The chart below shows the average price of gold every year since Pres. Carter’s first year in 1977. (Click on chart for larger view) The blue fields indicate years when Democrats were in the White House and the red fields show the Republican years. The black bars show the first inaugural year of each President.

In analyzing the chart, we find that:

- The Democratic years have generally tended to be better years for gold (particularly the Carter and Obama terms)

- The first year of NON-Incumbent Democratic presidents (1993 and 2009) have tended to support gold while the first year of NON-Incumbent Republicans (1981, 1989, 2001) have been less supportive.

However, there really isn’t a STRONG story to pull from this data. The wisest conclusion to draw would be that gold’s behavior is not strongly tied to Presidential terms. The stronger drivers would be the nation’s overall economic strength and global unrest (thus U.S. stagnation paired with the rise of Khomeni in Iran sparked gold’s leap at the end of Pres. Carter’s term).

The one takeaway from this analysis for investors to keep in mind is that normal post-election years (such as 2017) tend to be the weakest year in the presidential election cycle, however, as many have noted, President elect Trump won the White House by promising to overturn the norms. Couple the uncertainties over Mr. Trump’s exact policies and how they will affect the national debt with the large, looming questions over the EU and its immigrant crisis and you have a wealth of factors that historically buoy the yellow metal.

Disclaimer: This editorial has been prepared by Walter Pehowich of Dillon Gage Metals. This document is for information and thought-provoking purposes only and does not purport to predict or forecast actual results. It is not, and should not be regarded as investment advice or as a recommendation regarding any particular security, commodity or course of action. Opinions expressed herein are current opinions as of the date appearing in this editorial only and are subject to change without notice and cannot be attributable to Dillon Gage. Reasonable people may disagree about the opinions expressed herein. In the event any of the assumptions used herein do not come to fruition, results are likely to vary substantially. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate its ability to invest for a long term especially during periods of a market downturn. No part of this editorial may be reproduced in any manner, in whole or in part, without the prior written permission of Dillon Gage Metals. This information is provided with the understanding that with respect to the opinions provided herein, that you will make your own independent decision with respect to any course of action in connection herewith and as to whether such course of action is appropriate or proper based on your own judgment, and that you are capable of understanding and assessing the merits of a course of action. You may not rely on the statements contained herein. Dillon Gage Metals shall not have any liability for any damages of any kind whatsoever relating to this editorial. You should consult your advisors with respect to these areas. By posting this editorial, you acknowledge, understand and accept this disclaimer.