It’s becoming ever more difficult for the price of Gold to achieve a sustained rally, as we see the Yen, Euro and Sterling finding it difficult to stay afloat. This in turn supports a higher U.S. Dollar.

The news out of Italy continues to plague the Euro as many heads in Brussels are asking themselves what it will take to once again bail out Italy’s failing banking system.

It seems that the Wall Street Gold traders got it right yesterday, saying the rally in the price of Gold was a one off and sold into the rally. With the much stronger U.S. Dollar today, it looks like yesterday’s spot high of $1,239.80 will be the level to shoot for the next time around.

Truth and Consequences in the Gold Arena

I’m sure you all remember that for the longest time the price of spot Gold was locked in the trading range from $1,180 TO $1,210. Recently, with the Equity market declining and the increasing trade sanction news controlling the airwaves, the price of Gold was able to break out of its most recent trading range and achieve new highs.

The talk of trade sanctions becoming inflationary also caused some nervous shorts to head for the exits.

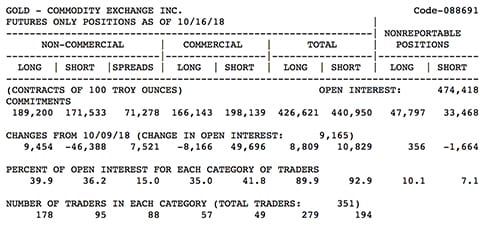

But to truly understand the impact of that news, we have to turn to the most recent Commitment of Traders report released this past Friday.

The report shows a huge reduction in the short position held by market participants.

Over 46 thousand short contracts exited the market causing a short-covering rally, moving spot Gold at that time up to spot high of $1,233.30. Once the U.S. Dollar started to head higher, the rally lost steam and the price retreated.

The good news is we are now trading above the 100-day moving average now at $1,223.60. Even though many Wall Street traders are holding on to new short positions there seems to be enough geopolitical risk to keep the price of Gold above the 100-day moving average number.

Understand that 46,000 contracts exiting a market this quick with very little physical demand is a big deal. But without solid fundamentals to take the price to the next level and above, we will just sit in this new trading range until a new catalyst appears. Will it be the results from the midterm elections? Possibly. Could it be China crying uncle and making a deal with the U.S.? Not likely. Maybe the stalling Brexit talks will give the price a boost.

In my opinion the “ONLY” thing right now that can give the price of Gold a significant boost is a Democratic victory in the midterm elections. This I expect will cause a significant correction in the Equity markets and a rush of investors moving to a safe haven in the Gold and Bond market investments.

Have a wonderful Wednesday.

Disclaimer: This editorial has been prepared by Walter Pehowich of Dillon Gage Metals for information and thought-provoking purposes only and does not purport to predict or forecast actual results. This editorial opinion is not to be construed as investment advice or as a recommendation regarding any particular security, commodity or course of action. Opinions expressed herein cannot be attributable to Dillon Gage. Reasonable people may disagree about the events discussed or opinions expressed herein. In the event any of the assumptions used herein do not come to fruition, results are likely to vary substantially. It is not a solicitation or advice to make any exchange in commodities, securities or other financial instruments. No part of this editorial may be reproduced in any manner, in whole or in part, without the prior written permission of Dillon Gage Metals. Dillon Gage Metals shall not have any liability for any damages of any kind whatsoever relating to this editorial. You should consult your advisers with respect to these areas. By posting this editorial, you acknowledge, understand and accept this disclaimer.