Gold extends its record-breaking rally early Wednesday after closing above $4,000 an ounce for the first time ever in the previous session. The bullion has risen 50% in the past year. Continue reading →

Gold extends its record-breaking rally early Wednesday after closing above $4,000 an ounce for the first time ever in the previous session. The bullion has risen 50% in the past year. Continue reading →

Gold rises above $3,900 an ounce to a new record high on haven demand early Monday and was poised just below the $4,000-an-ounce threshold. Silver joined the yellow metal’s rise, hitting over a 14-year high, solidly above the $48.00 an ounce mark. Continue reading →

Gold heads for its seventh consecutive weekly gain, though it was little changed early Friday, amid uncertainty surrounding the U.S. government shutdown. Spot gold hit a record high of $3,896.49 on Thursday and has gained 3.1% so far this week. Continue reading →

Gold hits new high, climbing to almost $3900 an ounce early Wednesday, boosted by haven investors after the U.S. government shut down.

Continue reading →

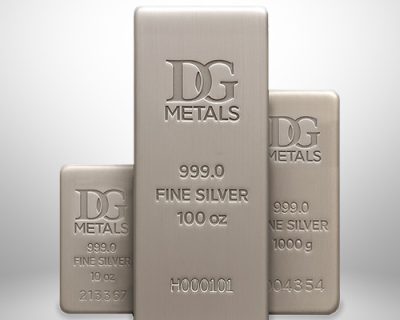

DALLAS (October 1, 2025)… Dillon Gage, a global leader in precious metals trading, refining and storage, today announced two significant advancements at its Dallas-based refinery: The official launch of a new facility producing serialized silver investment bars and the ISO 9001:2015 certification of its quality management system. Continue reading →

Gold tops the $3800 benchmark, hitting yet another record high early Monday as a potential U.S. government shutdown and geopolitical concerns drove safe-haven demand. The bullion was also buoyed by a softer dollar and expectations of more U.S. rate cuts. The surge follows gold’s sixth consecutive weekly gain as investors await further signals about the state of the economy and monetary policy. Continue reading →

Gold steady Friday, headed for a sixth weekly gain as investors access this morning’s inflation data that lifts rate cut hopes. U.S. inflation data came in line with expectations, reinforcing bets that the Federal Reserve may continue with interest rate cuts later this year. Meanwhile, platinum is at over a 12-year high. Continue reading →

Gold hits new record early Monday, ahead of a series of speeches by Federal Reserve policymakers that may shine additional light on monetary policy and the state of the economy, days after the central bank announced its first interest rate cut in nine months. Continue reading →

Gold set for fifth weekly gain despite a slight retreat early Friday from Wednesday’s record highs as the dollar strengthened. Traders await further cues on the direction of U.S. policy outlook two days after the Federal Reserve announced its first interest rate cut in nine months. Continue reading →

Gold retreats from record highs early Wednesday as the dollar strengthened and investors await direction from the Fed later today. Continue reading →

Gold rally continues ahead of Wednesday’s Fed meeting with gold futures dancing around the $3700 an ounce benchmark, supported by this morning’s subdued economic data and hopeful Chinese trade talk news. Continue reading →

Gold climbed back near a record high early Friday, heading for a fourth consecutive weekly gain after weak job and inflation data this week made it all but certain that the Federal Reserve will cut interest rates next week. Silver joined the soaring yellow metal, hitting a 14-year high. Continue reading →

Gold sticks near-record highs Wednesday after this morning’s softer than expected inflation data that combines with Tuesday’s labor market data to strengthen the case that the Federal Reserve will cut interest rates next week. Continue reading →

Gold extends record high this morning, solidly above $3600 an ounce. The yellow metal hit a record on Friday’s monthly U.S. jobs report that came in weaker than expected, solidifying bets that the Federal Reserve will cut interest rates next week and possibly as many as three times this year. Continue reading →

Gold hits new record above $3580 an ounce on this morning’s jobs report, headed for its third weekly advance as Friday’s key U.S. monthly jobs report data reinforces expectations that the Federal Reserve will cut interest rates later this month.

Nonfarm payrolls increased by just 22,000 for August, lower than the 75,000 forecast, while the unemployment rate rose to 4.3% according to the Bureau of Labor Statistics. The report showed a marked slowdown from the July increase of 79,000, which was revised up by 6,000. Revisions also showed a net loss of 13,000 in June. The August jobs report is one of the central bank’s most closely watched economic indicators, along with inflation. Today’s data shows that the labor market extended its weakness to the longest stretch since the pandemic. Gold is a traditional hedge against economic uncertainty. It also tends to rally when the Fed reduces interest rates, becoming a more attractive alternate investment.

December gold futures fell 0.8% Thursday to settle at $3,606.70 an ounce on Comex, and the yellow metal is up 2.6% so far this week. U.S. financial markets were closed Monday for the Labor Day holiday. Bullion added 5% in August after gaining 1.2% in July and slipping 0.2% in June. It’s up 37% this year. The metal rose 27% in 2024, its biggest annual gain since 2010. The December contract is currently up $27.70 (+0.77%) an ounce to $3634.40 and the DG spot price is $3593.80.

Ahead of the U.S. nonfarm payrolls report, ADP data showed Thursday that private-sector employment growth slowed last month. The report released Thursday showed an increase of 54,000 jobs in August, well below the 75,000 forecast by economists and the 104,000 the report showed for July.

In addition to the economic picture, gold has rallied on concerns about the Fed’s independence in setting monetary policy. U.S. President Donald Trump attempted to fire Fed Governor Lisa Cook for alleged mortgage fraud last week and she has sued to retain her job.

Separately, Stephen Miran, whom Trump nominated last month to fill the unfinished term of Fed Governor Adriana Kugler, said this week at his confirmation hearing that he doesn’t plant to leave his current position as chair of the White House Council of Economic Advisers if confirmed. That would give the White House a direct line to the traditionally independent central bank. Trump and his administration have long called for expedited rate cuts.

Over 83% of the investors tracked by the CME FedWatch Tool are betting that the Fed will cut rates by 25 points this month, while 16% say the rate cut will be 50 points. The central bank began raising interest rates in March 2022 to fight inflation, ultimately imposing increases of by 5.25 percentage points before beginning rate cuts last year. The Fed kept interest rates unchanged in July at 4.25% to 4.50%, a rate that it’s held all year.

The Fed’s favorite inflation measure, the personal consumption expenditures price index, came out last week with July data. The measure showed that core inflation rose to 2.9% in July, the highest level since February. The Fed’s inflation target is 2%.

Front-month silver futures lost 1.5% Thursday to settle at $41.42 an ounce on Comex, though the metal is up 1.7% so far this week. Silver rallied 11% last month after rising 1.5% in July and increasing 9.5% in June. It rose 21% in 2024. The December contract is currently up $0.418 (+1.01%) an ounce to $41.835 and the DG spot price is $41.46.

Spot palladium decreased 2.9% Thursday to $1,131.50 an ounce but is up 1.8% so far this week. Palladium decreased 7.8% in August after climbing 8.8% in July and surging 14% in June. Palladium dropped 17% last year. The DG spot price is currently up $5.70 an ounce to $1141.50.

Spot platinum retreated 4.4% Thursday to $1,376.30 an ounce, though it’s up 0.5% this week. It rose 5.9% last month after dropping 3.9% in July and climbing 27% in June. Platinum lost 8.4% in 2024. The current DG spot price is up $27.20 an ounce to $1398.80.

Disclaimer: This editorial has been prepared by Dillon Gage Metals for information and thought-provoking purposes only and does not purport to predict or forecast actual results. This editorial opinion is not to be construed as investment advice or a recommendation regarding any particular security, commodity, or course of action. Opinions expressed herein cannot be attributable to Dillon Gage. Reasonable people may disagree about the events discussed or opinions expressed herein. In the event any of the assumptions used herein do not come to fruition, results are likely to vary substantially. It is not a solicitation or advice to make any exchange in commodities, securities, or other financial instruments. No part of this editorial may be reproduced in any manner, in whole or in part, without the prior written permission of Dillon Gage Metals. Dillon Gage Metals shall not have any liability for any damages of any kind whatsoever relating to this editorial. You should consult your advisers with respect to these areas. By posting this editorial, you acknowledge, understand, and accept this disclaimer.

Gold extended gains early Wednesday on haven demand for the precious metal and increasing confidence that the Federal Reserve will cut interest rates at its upcoming meeting this month. Continue reading →

We will be available for trading and refining during the following hours.

Electronic trading available on FizTrade.com:

Dillon Gage trading desk and refinery:

Have a happy and safe Labor Day weekend!

Gold ticks up despite Friday morning’s inflation data and remains firmly above $3400 an ounce, headed for a weekly and monthly gain on a soft dollar and continued hopes that the Federal Reserve will cut interest rates next month. Continue reading →

Gold holds steady early Wednesday despite being pressured by a strengthening dollar, supported by the Fed turmoil, as U.S. President Donald Trump’s standoff with the Federal Reserve continues. Continue reading →

Gold slipped early Monday, coming off a two-week high, after the dollar strengthened coming off a four-week low. Continue reading →

Gold little changed, slipping early Friday on a stronger dollar as investors awaited further direction from Federal Reserve Chairman Jerome Powell’s scheduled remarks later in the day in Jackson Hole, Wyoming. Continue reading →

Gold gains on softer dollar Wednesday morning ahead of Fed minutes as investors await further direction from upcoming signals on monetary policy. Continue reading →

Gold edges up early Monday from a two-week low as investors awaited the result of an upcoming summit between Ukrainian President Vladimir Zelenskyy and U.S. President Donald Trump on steps toward a peace agreement between Russia and Ukraine.

Zelenskyy, Trump and key European leaders are set to meet in Washington on Monday, days after Trump’s summit with Russian President Vladimir Putin in Alaska. Separately, investors waited for signals on the Federal Reserve’s next moves on monetary policy.

December gold futures fell 3.1% last week to settle at $3,382.60 an ounce on Comex after the front-month contract slipped 60 cents Friday. Bullion gained 1.2% in July after slipping 0.2% in June and losing 0.1% in May. It’s up 28% this year. The metal rose 27% in 2024, its biggest annual gain since 2010. The December contract has currently ticked down $3.5 (-0.10%) an ounce to $3379.10 and the DG spot price is $3334.60.

Following Zelenskyy’s one-on-one talks with Trump in the Oval Office Monday, the leaders will meet with French President Emmanuel Macron, German Chancellor Friedrich Merz, British Prime Minister Keir Starmer, Italian Prime Minister Giorgia Meloni, European Commission President Ursula von der Leyen, Finnish President Alexander Stubb, and NATO Secretary General Mark Rutte.

On the economic front, the minutes of the last Fed policymakers’ meeting last month are scheduled for release Wednesday, and Fed Chairman Jerome Powell is set to speak Friday at the central bank’s annual gathering at Jackson Hole, Wyoming.

Investors are overwhelmingly betting on a rate cut at the Fed’s next policy meeting in September and most expect one more this year, though economic reports including on inflation and the labor market may affect policymakers’ thinking. Lower interest rates are typically bullish for gold, making the yellow metal a more attractive alternate investment.

The Fed minutes are likely to provide a snapshot of policymakers’ thinking when they voted to keep interest rates unchanged last month at 4.25% to 4.50%. The Fed has held at that rate all year, despite encouragement from the Trump administration to immediately impose cuts.

Over 85% of the investors tracked by the CME FedWatch Tool are betting that the Fed will cut rates next month. The central bank began raising interest rates in March 2022 to fight inflation, ultimately imposing increases of by 5.25 percentage points before beginning rate cuts last year. But two key reports released last week showed that U.S. inflation surged last month, weighing on the economy.

In economic news this week, U.S. housing starts for July come out Tuesday, followed by U.S. leading economic indicators for July and weekly initial jobless claims on Thursday. Then U.S. consumer confidence data comes out Friday.

Front-month silver futures decreased 0.2% last week to settle at $38.47 an ounce on Comex after the most-active contract rolled to December from September. The December contract fell 0.3% Friday. Silver rose 1.5% in July after increasing 9.5% in June and adding 0.6% in May. It rose 21% in 2024. The September contract is currently up $0.100 (+0.26%) an ounce to $38.075 and the DG spot price is $38.05.

Spot palladium tumbled 1.7% last week to $1,120.50 an ounce after falling 2.9% Friday. Palladium climbed 8.8% in July after surging 14% in June and advancing 2.8% in May. Palladium dropped 17% last year. Currently, the DG spot price is up $3.70 an ounce to $1122.50.

Spot platinum rallied 0.5% last week to $1,345.40 an ounce but declined 1.2% Friday. It dropped 3.9% in July after climbing 27% in June and rising 8.6% in May. Platinum lost 8.4% in 2024. The DG spot price is currently down $3.90 an ounce to $1338.30.

Disclaimer: This editorial has been prepared by Dillon Gage Metals for information and thought-provoking purposes only and does not purport to predict or forecast actual results. This editorial opinion is not to be construed as investment advice or a recommendation regarding any particular security, commodity, or course of action. Opinions expressed herein cannot be attributable to Dillon Gage. Reasonable people may disagree about the events discussed or opinions expressed herein. In the event any of the assumptions used herein do not come to fruition, results are likely to vary substantially. It is not a solicitation or advice to make any exchange in commodities, securities, or other financial instruments. No part of this editorial may be reproduced in any manner, in whole or in part, without the prior written permission of Dillon Gage Metals. Dillon Gage Metals shall not have any liability for any damages of any kind whatsoever relating to this editorial. You should consult your advisers with respect to these areas. By posting this editorial, you acknowledge, understand, and accept this disclaimer.

Gold flat early Friday but heading for a weekly dip after two key inflation reports released this week showed that U.S. inflation surged last month, weighing on the economy and hopes for a series of large interest rate cuts. Continue reading →

Gold ticks up early Wednesday, buoyed by a weaker dollar and growing U.S. Federal Reserve rate cut hopes for September following mild inflation data, but coming off recent highs after the White House said it wouldn’t impose tariffs on gold imports. Continue reading →

Gold retreats early Monday as traders awaited the Trump administration’s promised clarity about potential tariffs on the import of 100 ounce and 1 kilogram gold bars. Continue reading →

Gold climbed early Friday and headed for a weekly gain after a report that the U.S. was imposing tariffs on imports of 1 kilogram gold bars. Continue reading →

Gold eases early Wednesday following its longest rising streak since February as concerns about the state of the economy attracted haven investors. The bullion also slipping Wednesday as Treasurys rise. Continue reading →

Gold on the rise this morning as investors buy the dip with DG spot gold closing in once again on $3400 an ounce. The yellow metal had retreated early Monday in a likely technical correction after Friday’s rally following a weak jobs report that boosted speculation that the Federal Reserve would have to step up its timetable for interest rate cuts. Continue reading →

Gold surges after the morning’s soft U.S. jobs report. DG spot gold jumped $46.00 an ounce, while Gold futures rose back over $3400 an ounce. The yellow metal had been headed for a weekly loss early Friday on a stronger dollar and fading hopes for U.S. rate cuts. Continue reading →

Gold drops on GDP data this morning that shows the U.S. economy on solid ground as investors awaited further direction from the Federal Reserve’s scheduled policy statement in the afternoon. Continue reading →

Gold slips early Monday after the U.S. and European Union reached an agreement on tariffs, cutting through their previous stalemate. Continue reading →

Gold slips early Friday as haven demand eases due to growing optimism about trade deals between the U.S. and its main partners, particularly the EU. Continue reading →

Gold slipped early Wednesday after U.S. President Donald Trump announced a U.S.-Japan trade deal, easing the appetite for the precious metal by risk-off investors. Continue reading →

Gold and silver are strong in Wednesday morning trading on a weakened dollar and slumping Treasury yields, with DG spot gold back near $3400 an ounce. The yellow metal is also getting support from the fast-approaching August 1 U.S. tariff deadline. Continue reading →

Gold tipping up early Wednesday as the dollar slipped from a one-month peak and Treasury yields slid, while spot platinum is leaping to a near ten-year high, near $1500 an ounce. Continue reading →

Gold edges lower after Wednesday’s inflation report showed flat growth in June, in counterpoint to a report on Tuesday that showed marked inflation growth in the same month. Continue reading →

Gold rose to a three-week high early Monday amid U.S. President Donald Trump’s escalating trade war and associated concerns for the global economy. While silver hit a near 14-year peak. Continue reading →

Gold rose early Friday as new tariff threats against Canada from U.S. President Donald Trump and speculation about monetary policy increased haven demand for the yellow metal. Continue reading →

Gold dropped early Wednesday, on a strengthening dollar and firmer Treasurys. Continue reading →

Jason Laurie, Business Development Manager for Dillon Gage Metals, argues that a $4,000 spot price is “a serious scenario with a 70 percent probability,” placing the timeline around mid-to-late 2026 and potentially sooner if geopolitical shocks accelerate the trend. Continue reading →

Gold slipped early Monday, edging lower after U.S. President Donald Trump’s administration announced several countries would receive tariff reprieves as they work on trade agreements. Continue reading →

Gold rose over $10 an ounce from an early morning trading dip as U.S. jobs number shows a big miss for June. Continue reading →

Gold gains on weaker dollar, rising from a one-month low early Monday as the dollar index weakened, though lessening haven demand kept a lid on prices. Continue reading →

Gold heads for its second consecutive weekly loss as investors awaited the release of the Federal Reserve’s favorite inflation report for further direction. Meanwhile, platinum surged to the highest level since 2014 on supply concerns which also spurred palladium. Platinum has lost some of these gains, but is still firmly over $1300 an ounce. Continue reading →

Gold steady in Wednesday morning trading as the ceasefire between Israel and Iran seemed to hold, though concern about the economy kept prices elevated. Continue reading →

Gold steadied Monday on safe haven demand as traders awaited Iran’s response to the U.S. joining attacks against the Islamic republic over the weekend. Continue reading →

Gold fell early Friday heading for its first weekly loss in three weeks as haven demand eases. Continue reading →

Gold ticked lower Wednesday as investors awaited the afternoon’s economic guidance from the Federal Reserve for further direction. The yellow metal continues to get support from haven demand triggered by the escalating conflict in the Middle East. Continue reading →

Gold slips from near record highs this morning on likely profit taking. The yellow metal jumped over $3400 an ounce in overnight trading amid demand from investors seeking a haven against geopolitical and economic uncertainty. Continue reading →

Gold surged to the highest level in almost two months Friday on haven demand after Israel’s attack on Iran which reportedly killed some senior officials in what has been termed a “major” attack. Continue reading →

Gold continues its morning climb after a cooler than expected inflation report. The yellow metal had boosted earlier in the trading day amid haven demand from the standoff between state and federal authorities over immigration arrests in California. Continue reading →

Gold steady above $3300 an ounce in Monday morning trading supported by a weaker dollar as the U.S. and China were poised to resume trade talks over rare-earth metals and advanced technologies, and amid a standoff in Los Angeles over immigration. Continue reading →

Gold tips down on a stronger than expected jobs report, but the yellow metal is still aiming for a weekly advance, while silver hits a 13-year high. Continue reading →

Gold boosting during Wednesday morning trading on weak U.S. jobs report and ongoing haven demand driven by tariff war concerns. Continue reading →

Gold climbs to one-week peak early Monday on haven demand. Amid new uncertainty surrounding U.S. President Donald Trump’s trade and tariff policies the dollar weakened and the yellow metal jumped 2%. Continue reading →

Gold slips on a mild inflation report and on a social media post by President Trump attacking China. Continue reading →

Gold tips up early Wednesday as investors took advantage of the previous session’s dip and did some bargain hunting. The market now looks to this afternoon’s release of the minutes from the Fed’s recent meeting as prices remained under pressure as U.S-EU trade tensions eased. Continue reading →

Dillon Gage trading room and refinery will be closed in honor of Memorial Day, Monday, May 26th.

FizTrade.com

Thank you for your business. Have a safe Memorial Day Weekend.

*Subject to change without notice. Hours are dependent upon Globex Market hours.

Gold bumped up 1% on Friday, heads for the best week in six as U.S. fiscal concerns mounted after Moody’s Ratings’ U.S. credit rating cut late last week. Continue reading →