Part 2: Pricing and Supply

In the first installment of our three-part platinum series, we outlined how significant changes are being made in the platinum market as the metal moves away from outdated sources of demand, finds new avenues of demand in technology, and once again begins to appeal to investors. Today we’ll look at how the factors affecting supply and price are showing further signs that 2019 may finally start to bring a reversal of fortune for platinum.

Platinum is scarce

Platinum is one of the rarest precious metals in the earth’s crust. In fact, if you were to stand in an Olympic-sized swimming pool, all the platinum ever produced would barely cover your ankles. On the other hand, all of the gold ever produced would completely fill three Olympic-sized swimming pools, according to the World Platinum Investment Council. Today, the global supply of platinum is only around 1/10 the supply of gold and 1/100th that of silver.

Roughly 80% of mined platinum comes from the Bushveld Igneous Complex (Bushveld) in South Africa. As platinum’s fate is determined largely by one country, its supply is significantly impacted by political unrest, labor tensions, and intermittent power and water resources. And unlike gold and silver, there are no large above-ground platinum stockpiles to fill the gap if significant supply disruptions should occur.

Supply surplus is shrinking

You would think that platinum’s scarcity alone would keep it in short supply. Nevertheless, sliding automotive demand and increased recycling in past years has resulted in a supply surplus. But platinum is slowly but steadily climbing out of its surplus hole. Supply is expected to round out 2019 at a net 345 Koz surplus, which represents a sharp decrease from 675 Koz in 2018. Combined with platinum’s mining constraints and accelerating demand, it should continue to see a steady decrease in surplus supply and even a deficit in the years to come.

The price is right

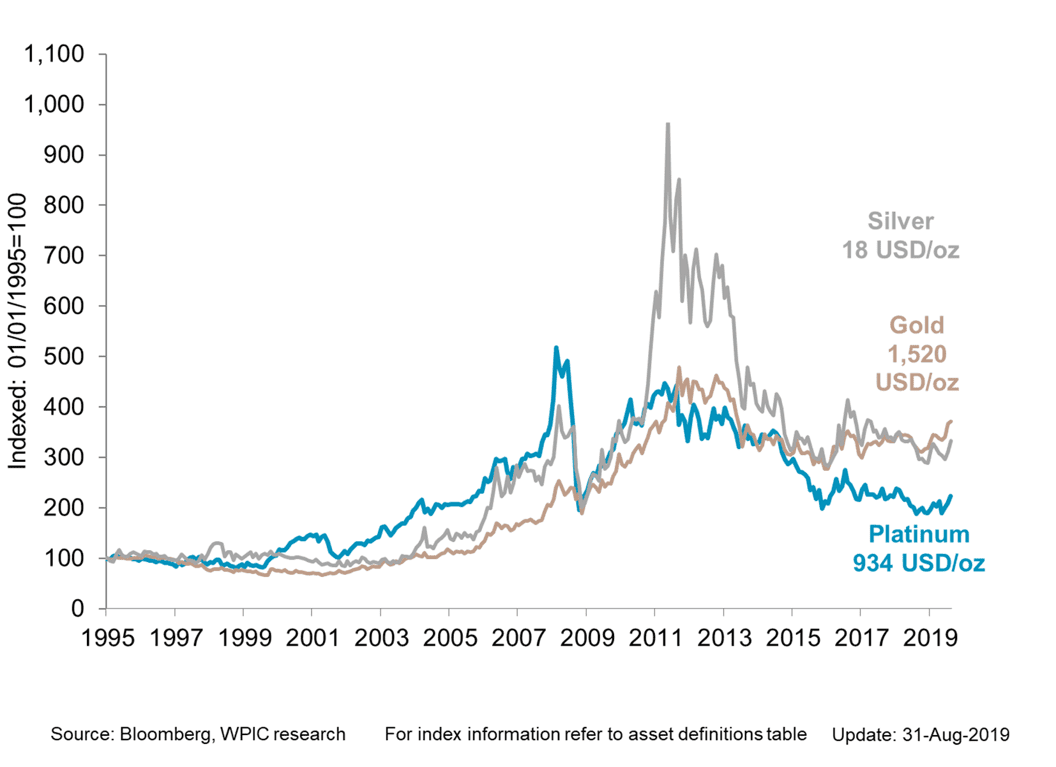

Most analysts solely concentrate on today’s bargain-basement platinum price in relation to gold. It’s true – for most of recorded history, platinum has been more valuable than gold. In the past 50 years alone, platinum was priced higher than gold 80% of the time, trading at double gold’s price at its peak.

But that is not the case today. Gold is currently trading at around $1500 an ounce and platinum at around $925, resulting in a gold-to-platinum ratio of 1.6 that has not been seen since the 1970’s. This means that at today’s levels, a troy ounce of platinum is only worth just over 60% of one ounce of gold.

Platinum languishing near its multi-year lows is enough to tempt any contrarian to buy. But price alone doesn’t mean that a metal should be added to a bullion portfolio. We saved the price discussion for last, because we feel that it’s best to view platinum’s long-term value through the wider lens of its demand, supply, and outlook.

And here’s what we know: Platinum is securing new and abundant sources of demand. Supply is scarce and its surplus is steadily shrinking. Fundamentals are improving for the first time in almost a decade, while sentiment remains near record lows.

As history has shown, it’s at precisely the intersection of dismal sentiment and strengthening fundamentals that bull runs are born. Which begs the question: have we already seen the bottom in platinum?

Check back next Friday, October 11th, to see how, despite its challenges in recent years, there is still room for platinum to shine in any bullion portfolio.

Disclaimer: This editorial has been prepared by Dillon Gage Metals for information and thought-provoking purposes only and does not purport to predict or forecast actual results. This editorial opinion is not to be construed as investment advice or as a recommendation regarding any particular security, commodity or course of action. Opinions expressed herein cannot be attributable to Dillon Gage. Reasonable people may disagree about the events discussed or opinions expressed herein. In the event any of the assumptions used herein do not come to fruition, results are likely to vary substantially. It is not a solicitation or advice to make any exchange in commodities, securities or other financial instruments. No part of this editorial may be reproduced in any manner, in whole or in part, without the prior written permission of Dillon Gage Metals. Dillon Gage Metals shall not have any liability for any damages of any kind whatsoever relating to this editorial. You should consult your advisers with respect to these areas. By posting this editorial, you acknowledge, understand and accept this disclaimer.