A recent report released by the World Gold Council revealed that first-quarter identifiable Gold demand slowed to a 10-year low of 973.5 tons. Continue reading →

A recent report released by the World Gold Council revealed that first-quarter identifiable Gold demand slowed to a 10-year low of 973.5 tons. Continue reading →

The Trump administration is pulling back on its harshest measures on Chinese investments in U.S. technologies. Continue reading →

Gold continues its sell off stance as short sellers continue to add on their positions, as seen in last Friday’s commitment of traders report. Continue reading →

Dillon Gage is a proud member of The Industry Council for Tangible Assets

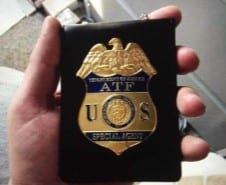

A New Jersey man admitted June 25 to impersonating a federal agent while selling counterfeit coins and bars and unlawfully importing counterfeit coins and bars into the United States, according to U.S. Attorney Craig Carpenito. Continue reading →

The lack of interest in the Gold market by traders, speculators and of course investors continues to keep the price of Gold seemingly locked in place. Continue reading →

The Dollar index is in negative territory this morning, giving the price of Gold a temporary reprieve from the lower prices it’s been hitting this week. Continue reading →

The stronger dollar index that is now at the 95 level is keeping Gold from edging higher. Meanwhile, investors and traders are preoccupied with all the news flooding the news channels on our ongoing immigration policy and a potential trade war with China. Continue reading →

Walter Pehowich is off today

After Frantic Friday, gold’s changes have settled down to a slightly positive mode. Continue reading →

ECB President Mario Draghi said yesterday that he will keep EU interest rates unchanged until summer next year, In contrast, U.S. Fed Chairman Jerome Powell took a more aggressive stance, trying to stay ahead of the curve, announcing continued rate hikes. Continue reading →

All eyes on the Fed today as a decision on interest rates will be released at 2pm EST. Continue reading →

Walter Pehowich is attending the IPMI conference. Today’s comments were compiled by Dillon Gage senior analyst

The precious metals market is calm across the board this morning, on pause as we await the details of the pending summit between President Trump and North Korean leader Kim Jong Un. Continue reading →

It took the United States Mint till the end of April 2018 to sell all remaining 2017 one ounce Gold eagles. Continue reading →

Technical levels have been broken thru the $1,010 level in spot Palladium. Currently, Palladium is up over $30 dollars since the futures opened. Continue reading →

A mixed bag of financial data is keeping the price of Gold range bound. Continue reading →

A weaker U.S. dollar and stronger U.S. Treasury yields keeping the price of Gold locked in place. Continue reading →

Market Headlines for this morning:

At the time of this report the price of Gold is trading down slightly. Continue reading →

Dillon Gage trading room and refinery will be closed Monday, May 28th, in honor of Memorial Day.

FizTrade, electronic trading, will be open*:

• Sunday, May 27th: 5pm Central through Monday, May 28th at Noon Central

• Monday, May 28th: Reopens 5pm Central and continues normal hours

Have a safe Memorial Day Weekend.

*Subject to change without notice. Hours are dependent upon Globex Market hours. .

Most of the Wall Street Gold traders I speak with daily have left already to enjoy the Memorial Day weekend. I can’t say I blame them as the beginning of the holiday weekend is shaping up to be spectacular here in New York with the second half not so good. Continue reading →

President Trump writes a letter to North Korean leader Kim Jong Un, calling off proposed summit, “for the good of both parties,” but as he put it, “to the detriment of the world.”

In turn, Gold and Silver rally on the news.

Have a wonderful Thursday.

Walter Pehowich is off today. The insights were compiled by a senior Dillon Gage analyst.

Gold hits the wall just shy of $1,300 this morning. Continue reading →

This weekend’s peace declaration in the Trade War gave the stock market a big boost…and gold took it on the chin. Continue reading →

Gold technical levels holding their position. A stronger dollar and softer treasury yields are keeping the price of gold in their place. Continue reading →

Overnight the price of Gold got a temporary boost off the news that North Korea just might cancel the meeting with President Trump. During that period the June CME gold contract traded up to $ 1296.40. Continue reading →

The price of gold blowing thru all support levels this morning as the U.S. Dollar and Treasury yields explode to the upside. Continue reading →

We start the week seeing the price of Gold and Silver trading sideways, as we view a weaker dollar and stronger treasury yields. Continue reading →

Geopolitical risks in the Middle East, a weaker dollar and softer Treasury yields are giving Gold a temporary boost. Continue reading →

Oil hits 71 dollars a barrel this morning and equities are on a roll, so investors seemingly are turning a blind eye to the Precious Metals arena. Continue reading →

President Trump decides to exit the Iran nuclear deal and the price of Gold rallies on the news.

The President says this was the worst deal we ever entered into. Allies up in arms on the

President’s decision after numerous tries to convince him otherwise.

The President says there is definite proof that Iran lied about their nuclear program.

The President said sanctions will be imposed on Iran and any of the U S allies that don’t follow us they will have to answer to their citizens.

Enjoy the rest of your day.

Disclaimer: This editorial has been prepared by Walter Pehowich of Dillon Gage Metals for information and thought-provoking purposes only and does not purport to predict or forecast actual results. This editorial opinion is not to be construed as investment advice or as a recommendation regarding any particular security, commodity or course of action. Opinions expressed herein cannot be attributable to Dillon Gage. Reasonable people may disagree about the events discussed or opinions expressed herein. In the event any of the assumptions used herein do not come to fruition, results are likely to vary substantially. It is not a solicitation or advice to make any exchange in commodities, securities or other financial instruments. No part of this editorial may be reproduced in any manner, in whole or in part, without the prior written permission of Dillon Gage Metals. Dillon Gage Metals shall not have any liability for any damages of any kind whatsoever relating to this editorial. You should consult your advisers with respect to these areas. By posting this editorial, you acknowledge, understand and accept this disclaimer.

Stagnant Gold prices are not helping attract the professional players into the market. Continue reading →

ADDISON, Texas (May 8, 2018) – Dillon Gage Metals, the premier precious metals wholesale firm, has launched an updated version of its leading online trading platform, FizTrade™. Continue reading →

Unemployment rate now 3.9 percent lowest in 18 years. The average hourly wage rose by 2.6 percent year over year indicating a continuation of a growing economy. Continue reading →

Traders are waiting to hear from the Fed today as they complete the Fed’s two-day meeting. A rise in rates is NOT expected at this meeting. Continue reading →

Israeli Prime Minister Benjamin Netanyahu is making an announcement right now that the Iranians have been cheating from the get-go with their nuclear capabilities.

The prime minister said, “I think the greatest threat to the world and to our two countries , and all countries, is the marriage of militant Islam with nuclear weapons and specifically the attempt of Iran to acquire nuclear weapons.”

The price of gold rallies on the news and equities sell off.

The U S Secretary of State Pompeo said: “We remain deeply concerned about Iran’s dangerous escalation of threats towards Israel and the region.”

We all hope level heads prevail and nothing develops from these announcements.

Enjoy the rest of your day.

Disclaimer: This editorial has been prepared by Walter Pehowich of Dillon Gage Metals for information and thought-provoking purposes only and does not purport to predict or forecast actual results. This editorial opinion is not to be construed as investment advice or as a recommendation regarding any particular security, commodity or course of action. Opinions expressed herein cannot be attributable to Dillon Gage. Reasonable people may disagree about the events discussed or opinions expressed herein. In the event any of the assumptions used herein do not come to fruition, results are likely to vary substantially. It is not a solicitation or advice to make any exchange in commodities, securities or other financial instruments. No part of this editorial may be reproduced in any manner, in whole or in part, without the prior written permission of Dillon Gage Metals. Dillon Gage Metals shall not have any liability for any damages of any kind whatsoever relating to this editorial. You should consult your advisers with respect to these areas. By posting this editorial, you acknowledge, understand and accept this disclaimer.

Investors are focusing on strong expected corporate earnings this week, turning a blind eye to the Precious Metals arena. Continue reading →

First quarter GDP comes in at 2.3 percent. In turn, the U.S. Dollar firmed up at 91.99, taking out the past Jan 12th high. Continue reading →

The front end of the U.S. Treasury yield curve is becoming attractive to investors as an alternative to Equities, without credit risk. Continue reading →

Ten-Year Treasury Yields at 2.96 percent heading for the 3.00 percent level are putting significant pressure on the price of Gold. Continue reading →

The price of Gold just can’t get going. A stronger dollar and higher Treasury Yields keeping the price of Gold in place. Continue reading →

There’s good news for everyone on Wall Street as strong corporate earnings were reported early this week led by transportation sector giants J.B. Hunt and Norfolk Southern. Continue reading →

The equity markets are turning a blind eye to all the political news and are waiting and watching for more corporate earnings to be released this week. Continue reading →

No movement in the Dollar Index nor in the Ten-Year Treasury Yields, so it’s no surprise that the price of Gold is virtually unchanged. Continue reading →

The Fed’s minutes from the March meeting reveal a hawkish tone. Here are the headlines from their March meeting. The Fed: Continue reading →

The price of Gold up this morning reacting to the Presidents tweet warning Syria that missiles are on the way. Oil prices also head higher on the news. Continue reading →

We start the week seeing little movement in the U.S. Dollar and bond prices across the globe. Equity markets continue their up one day, down one day posture, no wonder the price of Gold and Silver continue to be range bound. Continue reading →

Overnight, President Trump proposed an additional 100 billion dollars in Tariffs against China. The news was released yesterday around 7 pm and immediately equities sold off 400 points.

Off the news the price of Gold rallied 5 dollars but since then the price of Gold has come off as the U S Dollar has rebounded.

Things seem to be heating up between the U S and China as China’s Finance Minister said, “China will fight to the end and will retaliate on any trade sanctions the U.S. imposes”.

An all-awaited March Job numbers report released at 8:30 est. today revealed it was up 103k jobs, well below the consensus of 178k jobs. Average hourly earnings up 0.3 percent.

After the number was released, Equities dropped a little, the U.S. Dollar softened up a bit and the price of Gold and Silver recovered from their intraday lows.

Debts All – Folks!

On Wednesday, NBC news released a story revealing that the majority of millennials are in debt, hitting a pause on major life events.

Credit card debt, rather than student loans, are the most prevalent type of debt among the group.

The NBC News report claimed three out of every four millennials in the U.S. have some form of debt.

A quarter of millennials, those 18-to-34 years old, are over $30,000 in debt, including 11 percent who are over $100,000 in debt. Only 22 percent of millennials are debt free. Credit cards, meanwhile, are playing an even bigger role than student loans.

Three-in-ten millennials have less than $1,000 in their personal savings, and only 1 percent have over $100,000 saved. A quarter, 24 percent, have no personal savings.

So even though many are working, this kind of debt limits their ability to buy homes and save for retirement.

Now let’s look at the overall consumer debt as reported by Bloomberg news: A healthy economy can be a dangerous thing.

Americans have a history of loading up on debt in good times, then paying dearly when the bills come due. Adding to the pain: A booming economy is often accompanied by rising interest rates, which make mortgages, credit cards and other debt much more expensive. As the U.S. Federal Reserve raises rates, there are signs that consumers could be putting themselves in peril. “When consumers are confident, or over-confident, is when they get into credit-card trouble.”

Spending on U.S. general purpose credit cards surged 9.4 percent last year, to $3.5 trillion, according to industry newsletter Nilson Report. Card delinquencies are also rising. U.S. household debt climbed in the fourth quarter at the fastest pace since 2007, according to the Federal Reserve.

So after reading these headlines, along with pondering that potential trade war with China, how in the world, with good conscience, can the Fed raise rates at the next Fed meeting as planned?

Figures:

Credit card debt is typically based on the prime rate that’s directly linked to the Fed fund’s rate. If the Fed rate increases just a quarter-point, your card’s rate will increase, adding more pain to pay off the balance.

And now, with the threat of a trade war with China hanging over us, I expect many CEOs to rethink their spending, possibly holding off any capital expenditures until this is all cleared up. In other words, holding on to the cash from the tax cuts for a so-called “rainy day.”

This is my argument for higher gold prices. If this all comes to fruition, rising interest rates will slow the economy causing consumers to curb spending. Companies will be hesitant to hire new employees and will also curb spending. So In the end, the economy will slow and the Feds will not have the data to raise rates four times as expected. Hence ,investors will flock to Gold as a viable investment.

So later this year, the patient gold investors will get their reward as investors will realize once again that a truly balanced portfolio must have a portion of physical precious metals in its content.

Have a wonderful Friday.

Disclaimer: This editorial has been prepared by Walter Pehowich of Dillon Gage Metals for information and thought-provoking purposes only and does not purport to predict or forecast actual results. This editorial opinion is not to be construed as investment advice or as a recommendation regarding any particular security, commodity or course of action. Opinions expressed herein cannot be attributable to Dillon Gage. Reasonable people may disagree about the events discussed or opinions expressed herein. In the event any of the assumptions used herein do not come to fruition, results are likely to vary substantially. It is not a solicitation or advice to make any exchange in commodities, securities or other financial instruments. No part of this editorial may be reproduced in any manner, in whole or in part, without the prior written permission of Dillon Gage Metals. Dillon Gage Metals shall not have any liability for any damages of any kind whatsoever relating to this editorial. You should consult your advisers with respect to these areas. By posting this editorial, you acknowledge, understand and accept this disclaimer.

Overnight, China imposed tariffs on 106 U.S. products and markets across the globe reacted. Continue reading →

We start the week with markets closed all over Europe for Easter Monday.

Far East buying in Gold seen overnight as the U.S. Dollar declines against other world currencies. Continue reading →

Here are our hours of operation over the holiday weekend. Continue reading →

Final revised fourth quarter GDP figures released today come in at 2.9 percent. Continue reading →

We enjoyed a nice rally in the price of Gold last week, but holding up the rally from continuing further this morning are higher Ten-Year Treasury Yields and a significantly higher equity market due to a cooling off of trade war tensions with China. Continue reading →

Strong demand for the yellow metal overnight in the Far East. At the time of this report, the price of Gold is up over twenty dollars. Continue reading →

Here are the highlights from today’s meeting:

Lead by the new Fed chairman Jerome Powell, the Federal Reserve is expected to make its first rate increase in 2018, today at 2 PM EST. Continue reading →

Friday was a quadruple witching day (Quadruple witching happens when three related classes of options and futures contracts expire, Continue reading →

Someone start a fire……Please…..

Looking at a bar chart in gold, for the most part in 2018 the heavy bulk of trading has been between $1,320 and $1,350. Continue reading →

Walter Pehowich is off today. Today’s insights are provided by senior Dillon Gage staff.

Yesterday’s bumpy road in Washington gave us a short-lived bump up in gold prices. Continue reading →

The world stock markets had a positive reaction to the U.S. Jobs report from Friday, regaining some of their losses from earlier this year. Continue reading →

Terrific job number this morning adding 313,000 jobs in February. Eight hundred thousand people have entered the work force. All impressive news for a stronger equity market. Continue reading →